Importing goods from China to Australia offers excellent opportunities for businesses looking to access competitive pricing, diverse product ranges, and reliable manufacturing capabilities. To ensure a smooth import process, it’s important to understand logistics, customs regulations, and compliance requirements. This guide walks you through the key steps.

1. Understand Import Requirements and Product Restrictions

Before purchasing from Chinese suppliers, confirm whether your product is subject to Australian import restrictions. Items such as food, chemicals, electronics, and medical devices may require permits or additional certifications. The Australian Border Force (ABF) and the Department of Agriculture provide detailed guidelines.

2. Choose the Right Supplier

Reliable suppliers are the foundation of successful importing. Use platforms like Alibaba, Made-in-China, or direct factory contacts. Always conduct due diligence: request samples, check certifications (CE, RoHS, ISO), and verify business licenses. Working with a trusted freight forwarder or inspection company can help reduce risks.

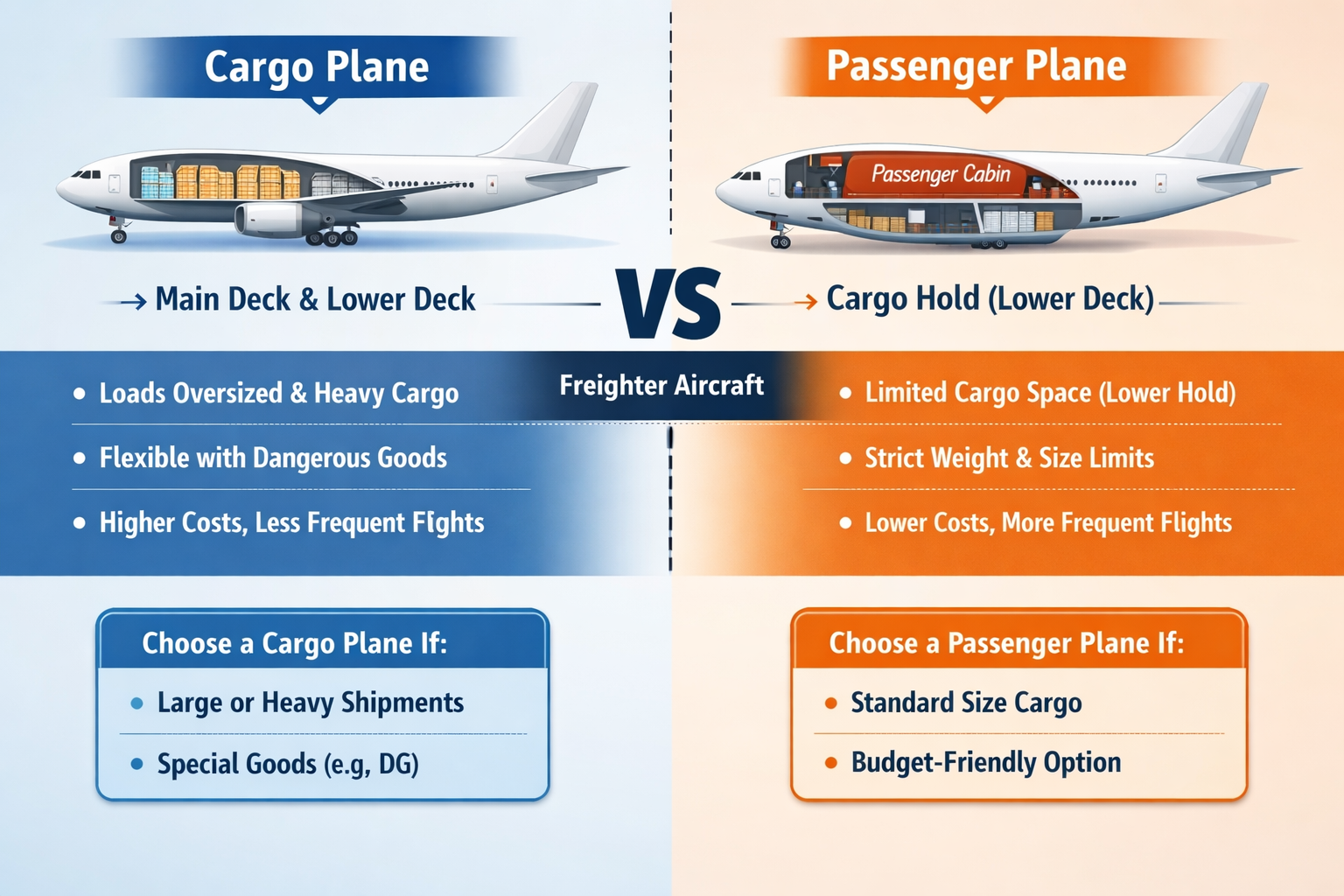

3. Select the Best Shipping Method

Your shipping method depends on delivery time, budget, and cargo size.

Sea Freight (FCL/LCL): Cost-effective for bulk shipments; transit time typically 18–30 days.

Air Freight: Fast and secure, suitable for high-value or urgent goods.

Express Courier (DHL/UPS/FedEx): Ideal for small parcels, door-to-door convenience.

4. Understand Duties, Taxes, and HS Codes

Australia applies import duties based on the HS code of the product. In many cases, goods from China may benefit from reduced or zero duty rates under trade agreements. Importers must also pay GST (typically 10%) on most goods.

Accurate classification and valuation are essential to avoid delays or penalties.

5. Prepare Proper Documentation

Common documents include:

Commercial Invoice

Packing List

Bill of Lading or Air Waybill

Certificates (if required)

Import permits (when applicable)

Ensuring correct documentation speeds up customs clearance and prevents unexpected costs.

6. Work with a Professional Freight Forwarder

A knowledgeable freight forwarder helps you:

Choose optimal shipping routes

Handle export and import customs

Arrange warehousing or delivery

Solve problems during transit

This is especially helpful for first-time importers.

7. Manage Final Delivery in Australia

After customs clearance, goods can be picked up from the port or delivered to your door through a trucking company or your freight forwarder. For e-commerce sellers, some providers offer direct fulfilment services.