Letters of Credit (LCs) are one of the most important payment tools in cross-border trade. They reduce payment risk by making a bank — not the buyer alone — responsible for paying the exporter once the agreed documentary conditions are met. LCs are especially common in international shipping because they allow sellers and buyers in different countries to trade with confidence.

Who’s involved (the main parties)

Applicant (buyer / importer) — asks its bank to open the LC.

Issuing bank — the buyer’s bank that issues the LC and undertakes to pay.

Advising/confirming bank — usually the exporter’s bank; may add its confirmation (an extra guarantee).

Beneficiary (seller / exporter) — presents documents to get paid.

Carrier / inspector / insurer — provide shipping documents or inspections required by the LC.

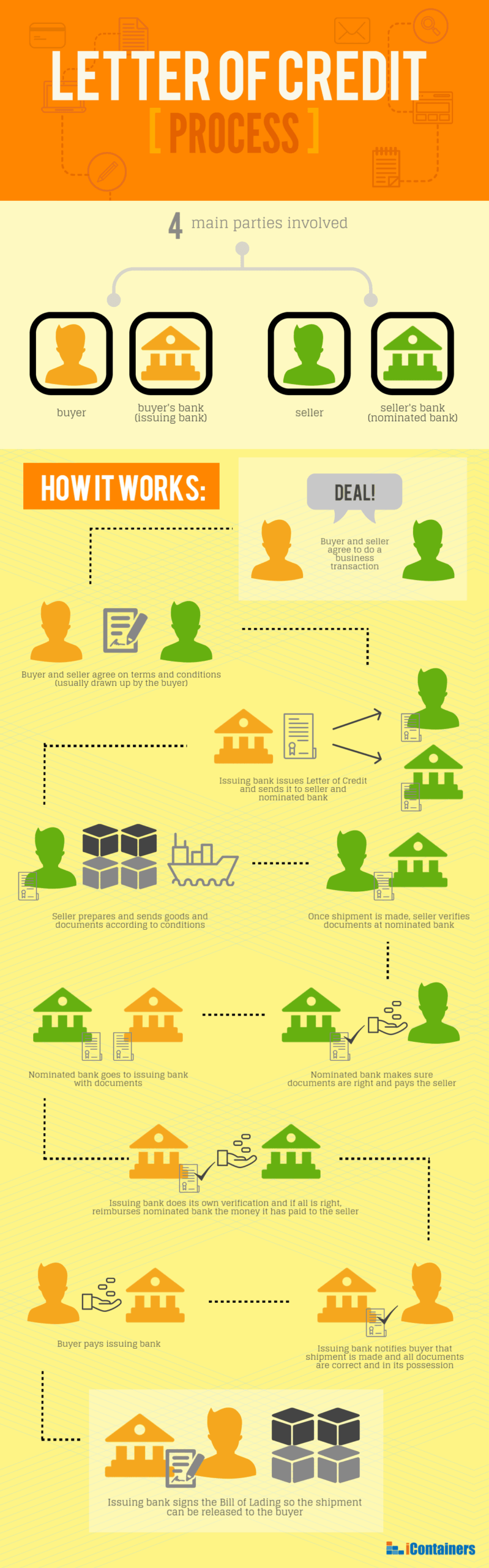

How a documentary LC works — step by step

Buyer and seller sign a sales contract that requires payment by LC.

Buyer applies to its bank for an LC containing the documentary requirements (invoice, bill of lading, insurance, packing list, certificates, shipment dates, etc.).

Issuing bank issues the LC and sends it to the advising bank.

Seller ships the goods and obtains the required documents (clean bill of lading, commercial invoice, packing list, insurance certificate, certificate of origin, etc.).

Seller presents the documents to the advising/negotiating bank. The bank checks them against the LC.

If documents comply, the bank honours/payment is made (immediate for a sight LC or at maturity for a usance LC). If not, the bank may present discrepancies for rectification.

Common types of LC

Irrevocable vs. revocable: Irrevocable LCs cannot be changed without agreement of all parties (the market standard).

Sight vs. usance (time): Sight pays on presentation; usance pays after a set term.

Confirmed LC: A second bank (often the exporter’s bank) guarantees payment in addition to the issuing bank — used when the exporter needs extra security.

Transferable, standby, revolving: Used for specific commercial needs (e.g., intermediaries, performance guarantee, repeated shipments).

For a fuller list and when to choose each type, see the ICC guidance.

Why exporters and importers use LC

Exporters get payment assurance if they comply with documentary terms.

Importers can secure that payment will only be released when specified documents proving shipment and quality are presented.

Banks add trust and operational discipline to the trade flow. However, LCs add cost and documentary complexity compared to open-account trade.

Key documentary and shipping tips (practical shipping-focused advice)

Match names and data exactly: Beneficiary name, consignee, invoice values, marks, and description must match the LC wording exactly — even small variances cause discrepancies.

Bill of Lading (BL) must meet the LC’s requirements: e.g., “clean on-board _____ vessel” or “freight prepaid” vs “freight collect.” Incorrect BL statements commonly cause refusals to pay.

Dates and deadlines: LCs usually require presentation within a specific number of days after shipment — don’t miss them.

Allowable discrepancies: Agree in advance how to handle minor discrepancies (e.g., courier corrections or bank acceptance) — banks can be strict under the UCP rules.

Consider confirmation: If political, commercial, or banking risk exists in the issuing bank’s country, ask for a confirmed LC.

Bring specialist counsel for complex LCs: Legal or trade-finance advisors help draft LC terms that fit shipping realities (transshipment, partial shipments, inspection certificates, etc.).

A short example

An exporter in China agrees to sell 1,000 units at $50 each to an importer in Germany (total $50,000). The contract requires an irrevocable, confirmed sight LC from a major German bank, payable against: (1) commercial invoice, (2) on-board ocean bill of lading marked “freight prepaid,” (3) packing list, (4) insurance certificate (110% CIF value), (5) certificate of origin.

The importer’s bank issues the LC and the exporter ships the goods. The exporter presents the documents to its advising bank; the documents exactly match the LC and the advising bank forwards them to the issuing bank. Both banks honour payment at sight and the exporter receives funds. If the BL had said “freight collect” while the LC demanded “freight prepaid,” the issuing bank could refuse to pay because of the discrepancy — delaying or extinguishing the exporter’s right to immediate payment. (This illustrates the importance of precise documentary control.)

Quick checklist before you rely on an LC

Is the LC irrevocable and confirmed if needed?

Are documentary requirements realistic for the actual shipping process?

Do names, addresses, amounts, and INCOTERMS match the commercial contract and shipping documents?

Who bears banking fees and who arranges document presentation?

What’s the allowed presentation period after shipment?

Summary

Letters of Credit remain a powerful way to reduce payment and performance risk in international shipping — but they shift the risk from an open commercial relationship to a documentary one. Success comes from drafting precise LC terms that reflect how the goods will be shipped and ensuring the exporter prepares airtight documentation. For legal or high-value transactions, involve trade-finance specialists or your bank early on to avoid costly discrepancies.